Donor-advised funds (DAFs) offer tax breaks on contributions including cash, securities, and assets like crypto. They defer taxes and exempt gains, streamlining charitable giving. For more tax strategies, email [email protected]. #taxstrategies #DAFs #taxbreaks

Do you want to make the most out of your business income by taking advantage of #taxbreaks and allowances? We provide reliable, professional accountancy and business advice to help clients manage their personal and business finances.

Contact us today

#charteredaccountant

Harnessing the benefits of tax deductions like a pro! 📊💸 #TaxHacks #FinancialWisdom #MoneyMindset #TaxBreaks #WealthBuilding #SmartFinance

🇺🇸 Committed to Our Veterans: No Taxes for Combat Vets & Tax Breaks for Service Members! Join the Fight for Their Rights! 💪 What do you think about the 'value-added tax'? Share your thoughts! 💬 #PhillipDrake #2028Election #VeteransRights #TaxBreaks #UnitedForChange

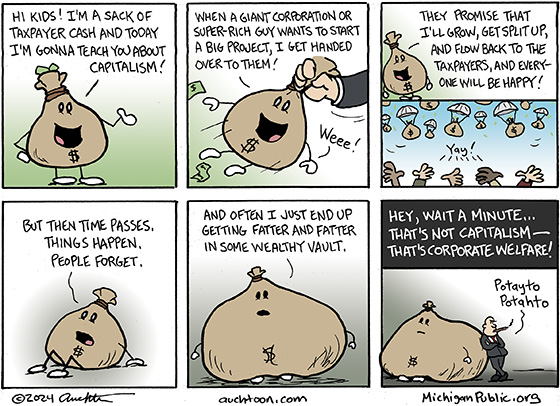

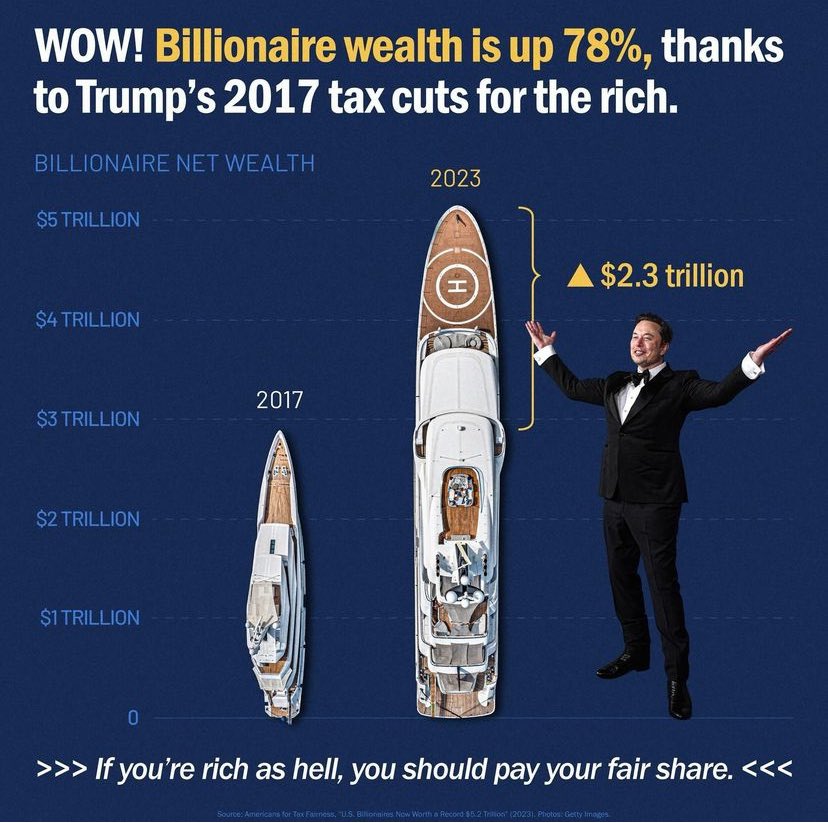

#MAGA : We don’ts need no #infrastructure !

We want more #taxbreaks for the rich dammit! 🤣

#Trump #Trump 2024NowMorethanEver #Trump 2024TheOnlyChoice #TRUMP2024ToSaveAmerica

#AmericaFirst #MAGA 2024 #Trump Train #NCSWIC #BidenSucks #FJBiden #Michgan #VoteRed #VoteTrump #Wisconsin

Who’s #voting for MORE #taxbreaks for the rich?

#Trump Trial

#Trump #Trump 2024NowMorethanEver #Trump 2024TheOnlyChoice #TRUMP2024ToSaveAmerica #MAGA

#Michgan #AmericaFirst #MAGA 2024 #Trump Train #NCSWIC #BidenSucks #FJBiden #BidenWorstPresidentEver #Wisconsin #VoteRed #VoteTrump

Who’s #voting for MORE #taxbreaks for the rich?

#Trump Trial

#Trump #Trump 2024NowMorethanEver #Trump 2024TheOnlyChoice #TRUMP2024ToSaveAmerica #MAGA

#Michgan #AmericaFirst #MAGA 2024 #Trump Train #NCSWIC #BidenSucks #FJBiden #BidenWorstPresidentEver #Wisconsin #VoteRed #VoteTrump

Who’s #voting for MORE #taxbreaks for the rich?

#Trump Trial

#Trump #Trump 2024NowMorethanEver #Trump 2024TheOnlyChoice #TRUMP2024ToSaveAmerica #MAGA

#Michgan #AmericaFirst #MAGA 2024 #Trump Train #NCSWIC #BidenSucks #FJBiden #BidenWorstPresidentEver #Wisconsin #VoteRed #VoteTrump

As a Canadian homeowner, you may be eligible for tax deductions on mortgage interest and property taxes. Explore these opportunities to ease your tax burden! #Homeownership #TaxBreaks

Who’s #voting for MORE #taxbreaks for the rich?

#Trump Trial

#Trump #Trump 2024NowMorethanEver #Trump 2024TheOnlyChoice #TRUMP2024ToSaveAmerica #MAGA

#Michgan #AmericaFirst #MAGA 2024 #Trump Train #NCSWIC #BidenSucks #FJBiden #BidenWorstPresidentEver #Wisconsin #VoteRed #VoteTrump

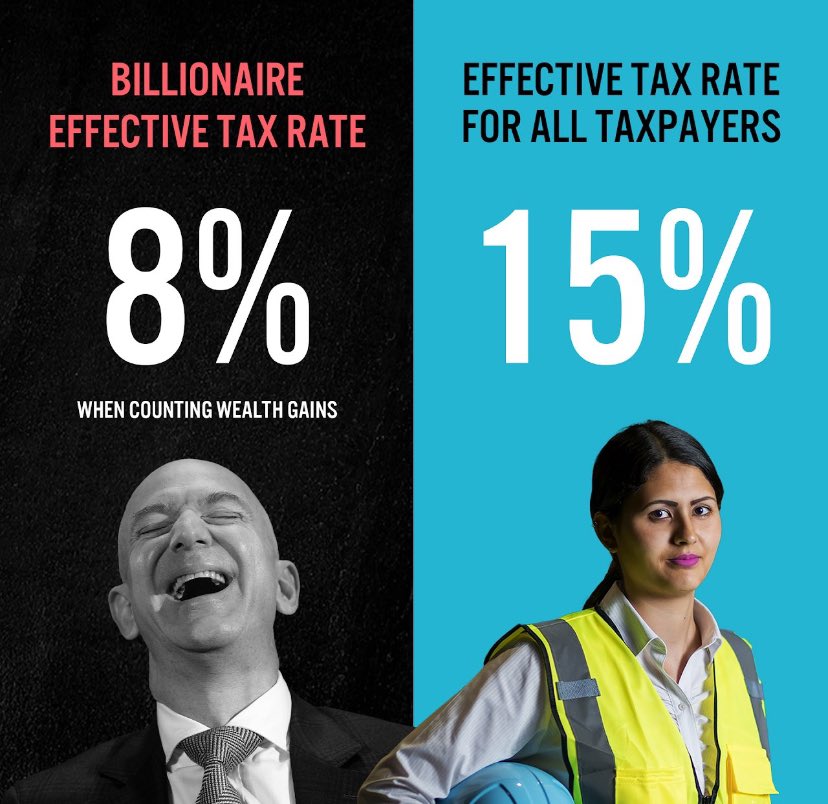

#WealthyCanadians get huge #taxbreaks ,even with 66% tax of gains >$250K.Assuming they’re in the top tax bracket where the rate is 53%,they’ll pay a greatly reduced rate of just 35%(on gains above $250K),and they’ll continue to pay just 26% on gains< $250K thestar.com/opinion/contri…

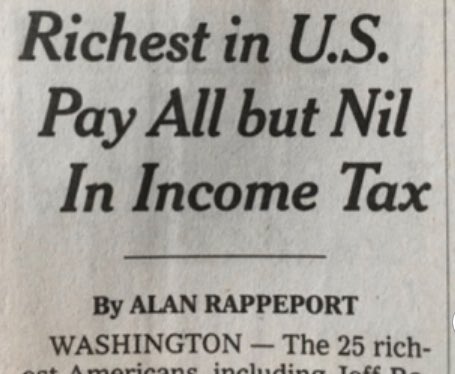

🇺🇸🇺🇦Ⓜ️Ⓜ️Eugene Jones 🪖🦺🤼🙏 Biden-Harris HQ Indeed, Trump wants to pay for his emerging #totalitarianism with the #oligarchs he enriches through more billionaire #taxbreaks , as we #middleclass worker bees pay for them.

#VoteBiden2024 , who has and will defend our Const’l rule of law from #MAGA madness.

Michele

csd 🇺🇦

The home office deduction can be a valuable tax-saving opportunity for many self-employed taxpayers. Here's an overview of who's eligible & how to compute your deductions #taxbreaks #taxdeductions #TaxTwitter sprou.tt/1aicY4oUo5t

The LS2 team will work with you year-round to ensure you will not be in this same position next year. Our clients are always prepared for tax time.

#financialfreedom #lifestrategies #antomiuswise #tax strategies #tax breaks #tax #tax es #business

I #hope & #pray that the #workingclass and #lowerclass will realize that it would not be wise to vote for a previous administration that gave enormous #taxbreaks to the #wealthiest . The richer they've gotten, the more you've struggled. #Pay fairly. 🤔

reuters.com/markets/us/us-…

The New York State budget includes housing tax breaks that apply in Long Island, including a program to create accessory dwelling units.

therealdeal.com/new-york/2024/…

#housing #taxbreaks #affordablehousing #housing crisis #ADU