Upcoming #Q4FY24 Results Today 19 May 2024

💚 Rainbow childrens medicare

🍏poddar pigments

💚choksi imaging

#RAINBOW #PODDARMENT

#CHOKSI

#STOCK2WATCH

#Stockmarketindia

कैसे रह सकते हैं #SAIL के नतीजे ? बता रहे हैं सुमित मेहरोत्रा..

Sumit Mehrotra #Q4Results #Q4FY24

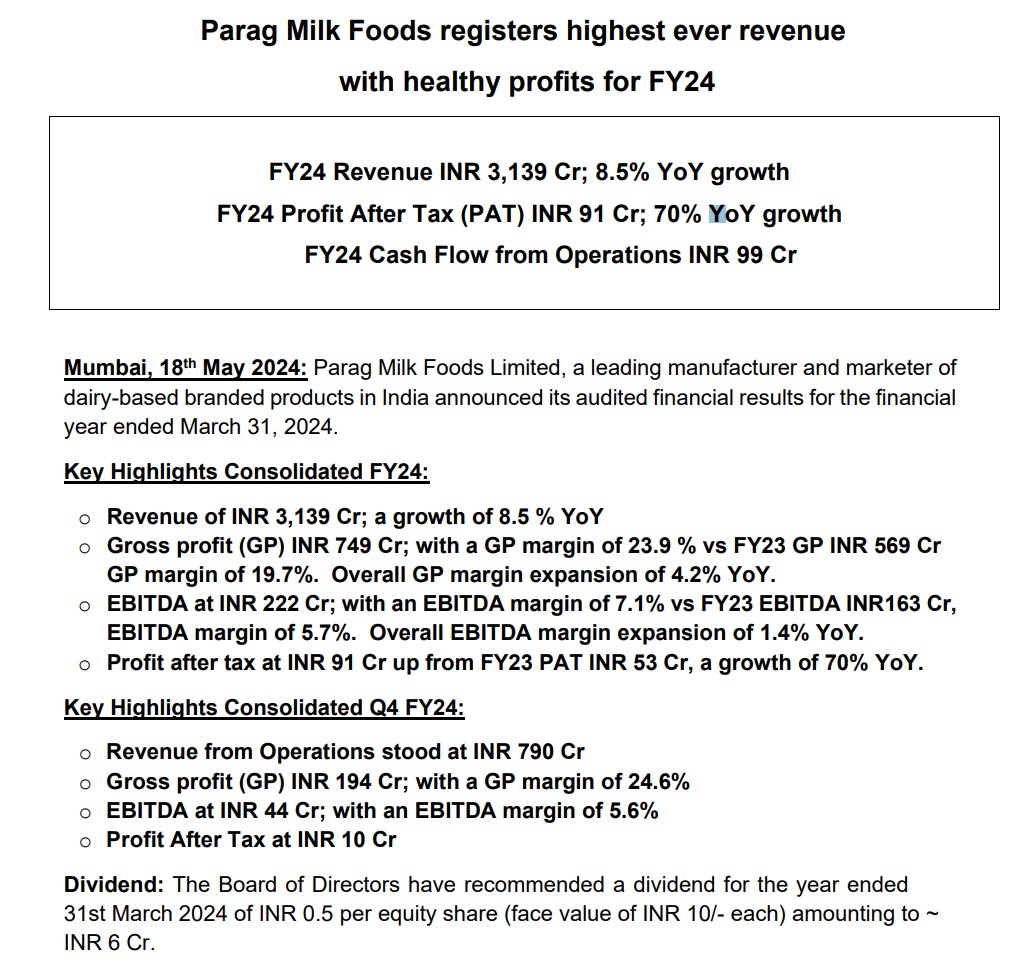

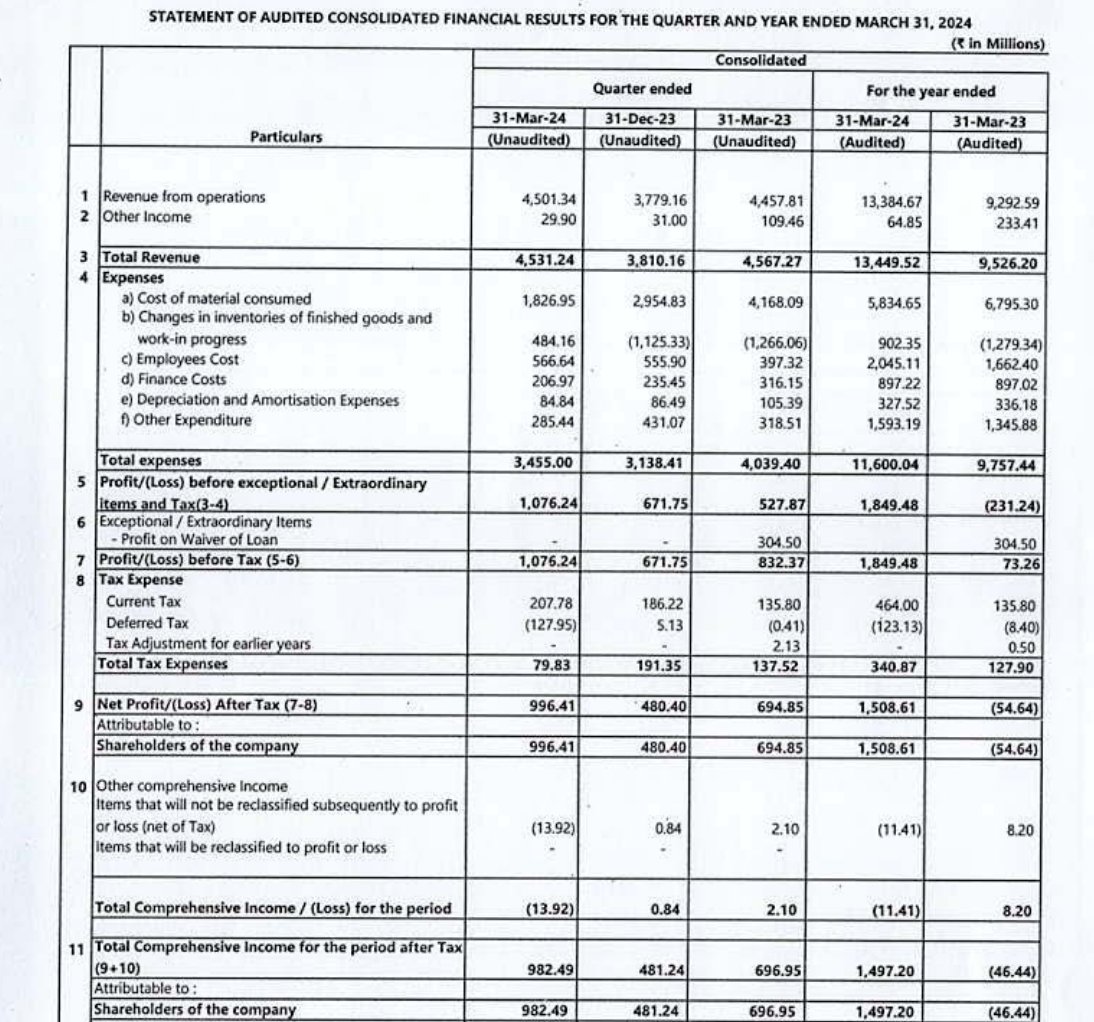

Parag Milk #Q4FY24

poor nos due to cyclity in the biz

Revenue stood at INR 790 Cr vs 801 Cr YoY

EBITDA at INR 44 Cr vs

EBITDA margin of 5.6%

Net Profit at INR 10 Cr vs 22 Cr

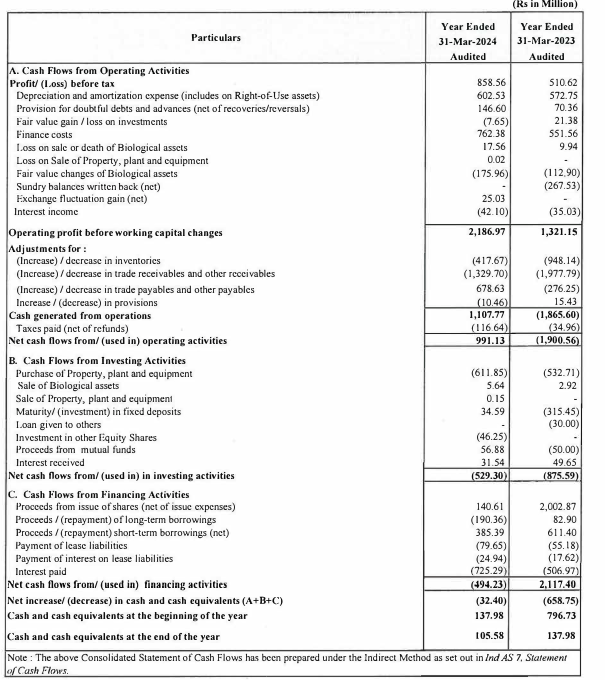

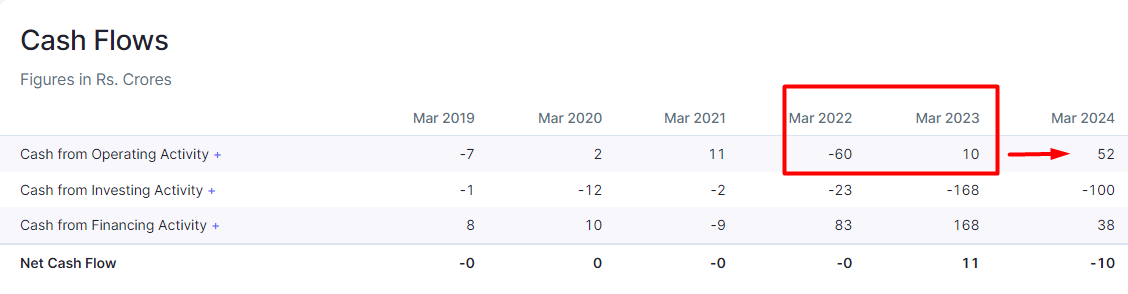

FY24 OCF 99 Cr vs -190 Cr in FY23

Receivables 244 Cr vs 168 Cr

#paragmilk #stockstowatch