🏡 Ready to find your dream home? Join us at our Open Houses this weekend! 🎈 #OpenHouse #HouseHunting #RealEstate #TheFurlanGroup #PoweredByPLACE #KellerWilliamsClassicGroup #SarasotaHomes #DreamHome #WeekendPlans #PropertyForSale #HomeBuyers #SarasotaRealEstate #HouseTour

Are you still experiencing the joys of recently getting married? Why stop there? Gift funds could be an excellent source for the down payment on your new home. Ask us about your options today!

#Mortgage #Homebuyers #Mortgage Broker #HomeLoans

Absa South Africa I would choose an Absa Home Loan because Absa offers a home loans of up to 105% for first-time homebuyers. #WeDoMoreWednesdays ❤️ #YourStoryMatters

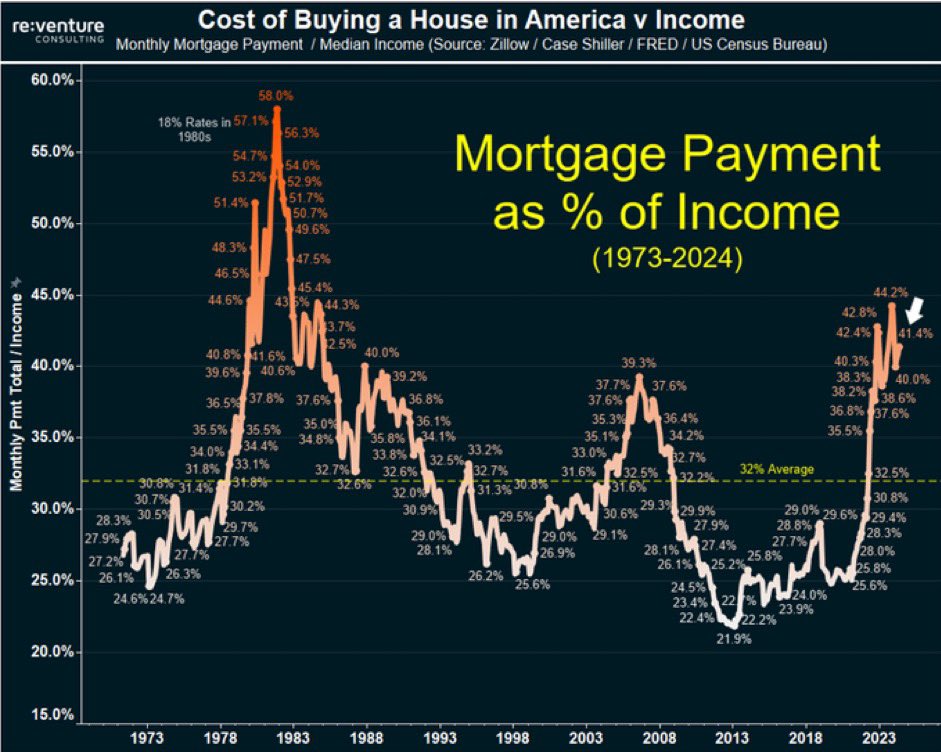

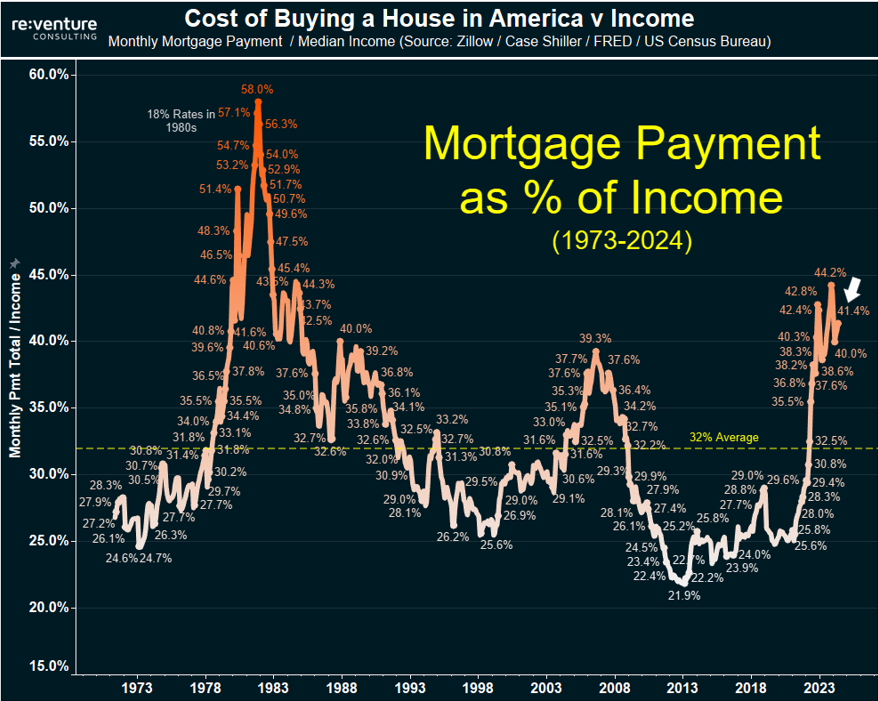

“Strong price gains continue to plague would-be homebuyers in today’s higher-rate environment, but for existing homeowners the picture keeps growing brighter,” said Andy Walden, ICE Mortgage Technology. #housing #market

By Bonnie Sinnock nationalmortgagenews.com/news/home-equi…

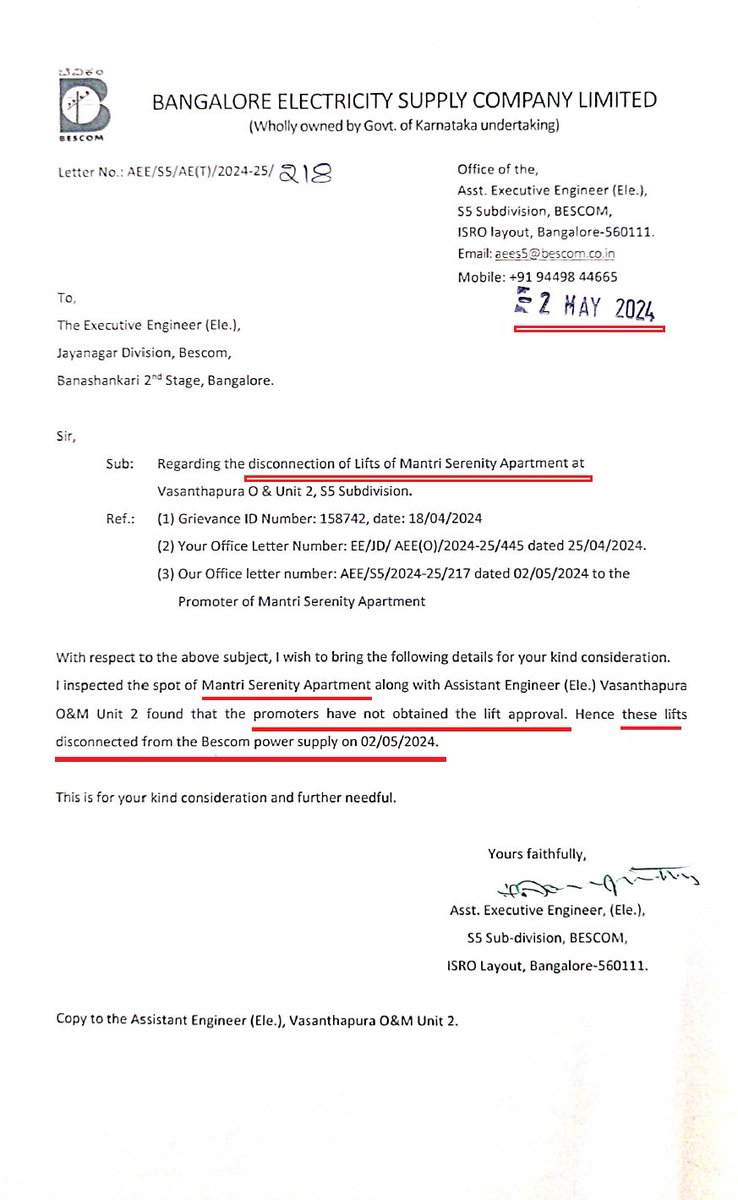

Dear Bangalore Development Authority, How can you give OC without having LIFT Approval? BESCOM has disconnected the power supply to Lifts because of the absence of approvals. How people should to go higher floors in the absence of Lifts? Please ensure we have approvals from Govt. Karnataka Home Buyers Forum

Providing a video tour of your home is a great way to give potential homebuyers a unique look at all it has to offer.

#KevinSmootRealtor , #AvonRealEstate , #HomesForSale , #HouseForSale

Times have changed and the days of 20% down are gone. At CCM, we offer loan programs for first-time homebuyers tailored to you, so owning a home is more achievable & affordable. Talk to us to learn more than one way around a large down payment. spr.ly/6014jn1fY #DreamHome